Assisted Banking Platform

We provide a holistic set of features around merchant management, txn management, limits, risk and compliance to leverage networks.

With a complementary suite of products from alternative SME lending, personalized line of credit and a fully integrated India stack to provide retailers the opportunity to unlock the many benefits of financial inclusion.

We provide a holistic set of features around merchant management, txn management, limits, risk and compliance to leverage networks.

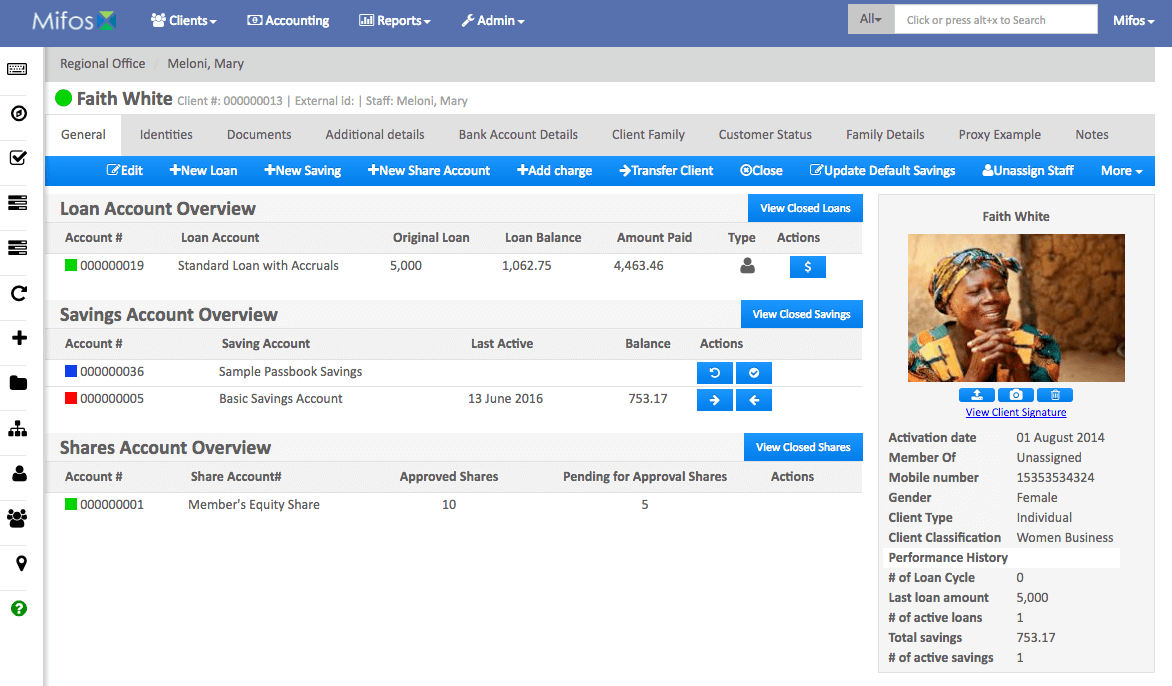

Our Joint Liability Group product is specifically designed for small ticket sizes to drastically reduce operational c osts through bulk and straight through processing and field force management.

For SMEs we offer term loan and revolving overdrafts for working capital. To assist underwriting, we provide a flexible rule engine, bureau integ rations, feeds from bank accounts, SMS scraping, GST data, Bharat Billpay data, other alternative sources and OCR capabilities.

aWe providing affordable, personalised offers to customers through a line of credit. This alternative overdraft account has a drawdown made against the available credit facility to allow the customer to access funds up to the agreed limit with many variations of linking custom terms to checkouts consisting of goods and services.

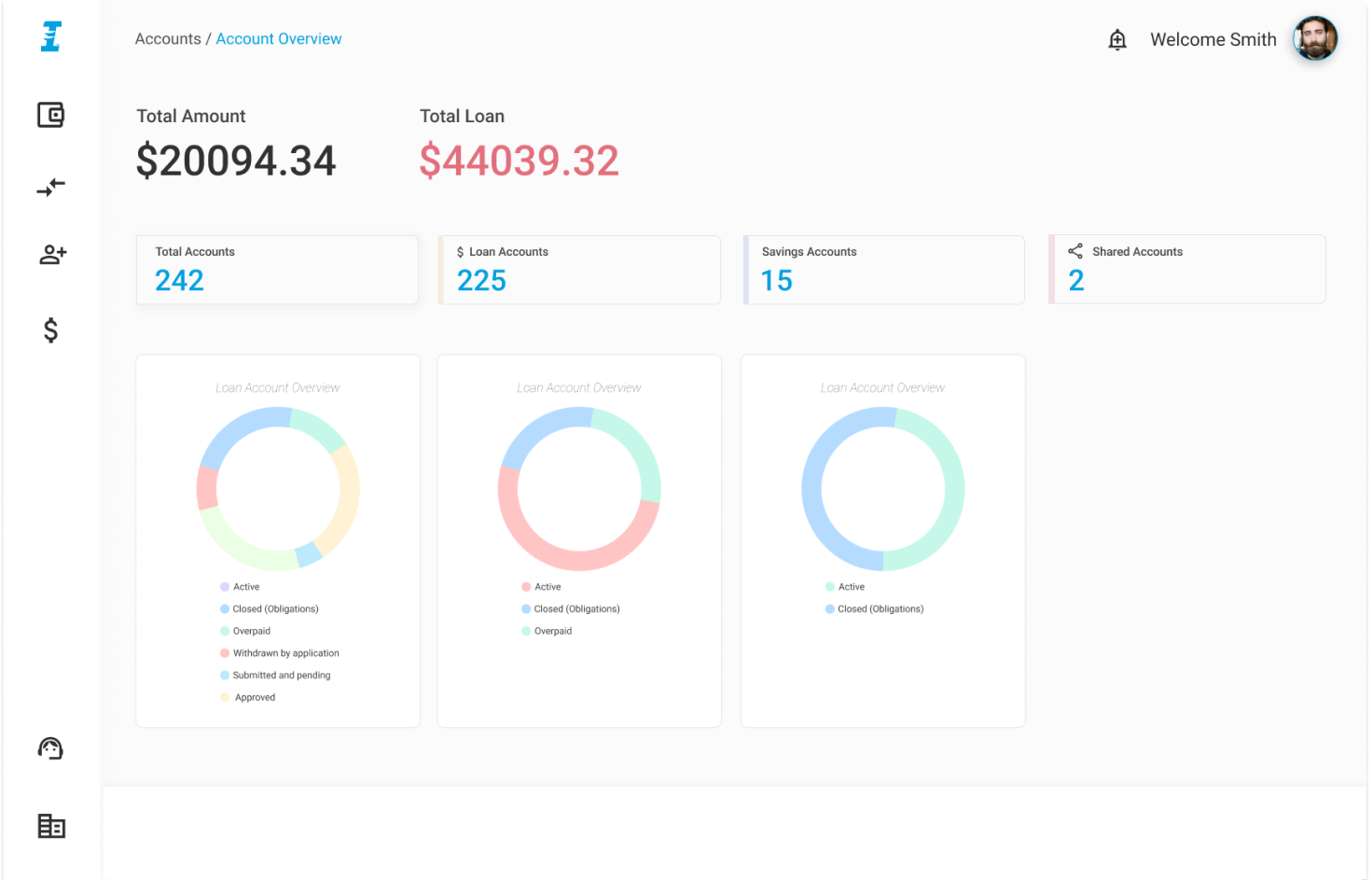

This webapp and android based app allows end users to access information and perform routine tasks like applying for a loan, repaying a loan, initiating account transfers, managing CASA and deposits.

GithubThis supports the back office roles at all organization hierarchy levels to carry out loan management, loan origination, collections, wallet / CASA management, deposit management and treasury management.

Github

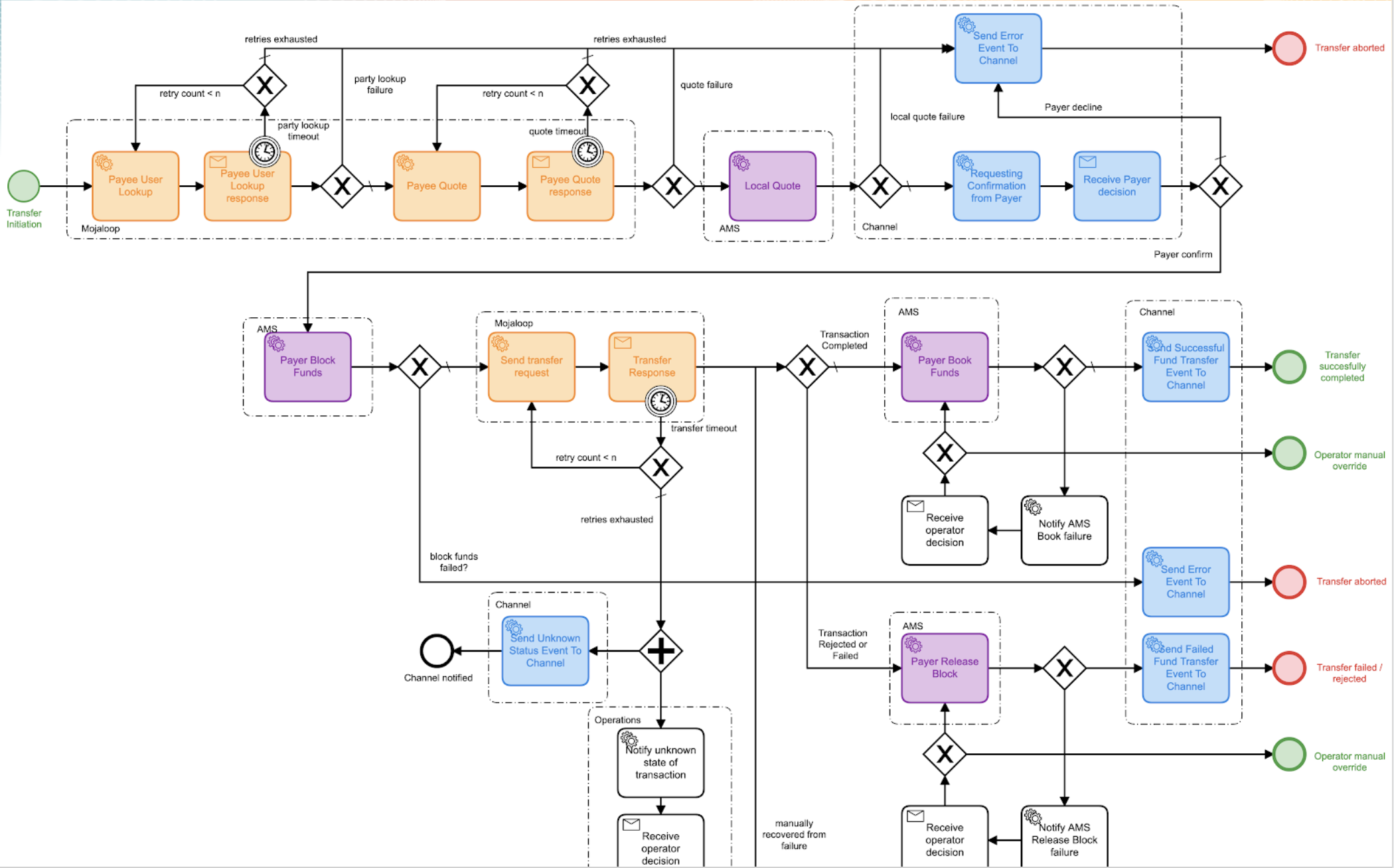

Production-ready architecture supporting deployments of real-time payments and switches. Enterprise-grade tool with extensible architecture to connect and integrate with multiple third party payment providers.

In today's digital age, the payments industry is increasingly driven by information and data. While this is nothing new, card issuers, retailers and acquirers have realized that gaining better insights into customer behavior provides a deeper understanding of sales and customer spending patterns.

Github

Fynarfin offers an exhaustive set of India stack capabilities from Aadhaar Authentication, Paperless eKYC, eSign, UPI (Universal Payment Interface), Bharat Bill pay and Bharat QR. These capabilities are seamlessly integration into all payments, loan origination and servicing offerings.

The GSMA harmonised API initiative aims to increase adoption of the mobile money API through dedicated engagement with mobile money providers and support for ecosystem vendors. The GSMA also aims to maintain updated versions of the API Specification with new features and up to date functionality.